Berlin is changing. Gentrification and displacement in the course of Berlin’s real estate boom have long been a topic of discussion and a reason for a broad rent policy movement that demands the right to the city for all. But what about the question of the new property ownership? What enables the new landlords – real estate corporations, investment funds and countless anonymous owners and letterbox companies – to access the social good of housing? Who are the real actors behind the economic exploitation of urban space? And how can we politically and socially contain, control and thwart their actions?

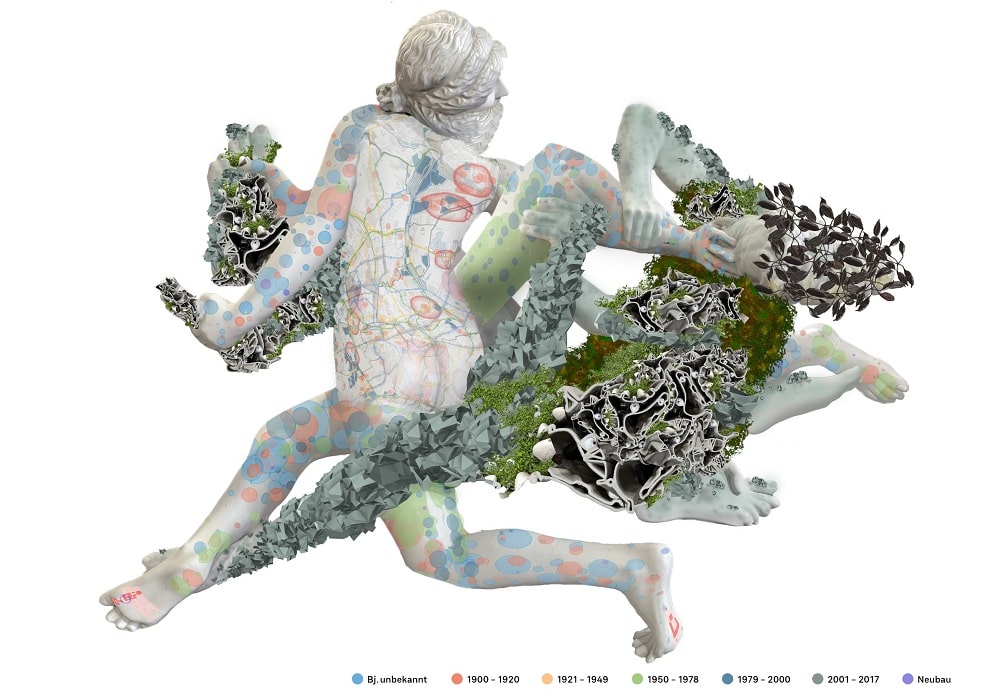

Image above: Courtesy NGBK

In this series of events, the nGbK presents artistic-performative actions in urban space, moderated city walks, lectures, talks as well as workshops and radio features at various locations. With: Wouter Bernhardt, coop disco, Kathrin Gerlof, Jenny Goldberg, Susanne Heeg, Lorena Jonas, Alexis Hyman Wolff, Sandy Kaltenborn, knowbotiq (with Pablo Torres), Achim Lengerer, Yves Mettler, Louis Moreno, Ines Schaber, Kathrin Wildner.

The nGbK research project X Properties addresses the urban changes in the course of financialisation, i.e. the increasing presence and importance of financial capital in the Berlin real estate market. This is contrasted with a collectively developed perspective on a desirable city. A practice of collective learning with workshops, moderated city tours, talks and artistic contributions combines research and wish production. An issue of the Berliner Hefte on the city’s history and present will be published as an accompanying booklet.

The interconnections of finance and real estate, their effects on local neighbourhoods and the global transformation of the urban are at the centre of the research on X Properties. Together with urban researchers, activists and artists, the project discusses the impact of financial capital on the social and cultural production of the city, on its forms of relationships and subjects, and asks what forms of a de-financialised city can be opposed to this. The project strives for an understanding of its own and thus for resistant possibilities of action in the face of an abstract economisation of urban life.

With the sale of the commercial courtyard at Oranienstraße 25 by Berggruen Holdings to the Luxembourg-registered Victoria Immo Properties V S.à r.l., the nGbK itself is also affected by this dynamic. In its immediate vicinity, on Prinzenstrasse close to Moritzplatz, a commercial area with high-priced Kreuzberg “creative flair” is being built. Adjacent to it is the Otto-Suhr-Siedlung, which was taken over by the Vonovia SE housing group with the acquisition of Deutsche Wohnen.

The new alliance of land ownership and finance capital is noticeable in all districts of Berlin. Behind this is a transformation of the global economy: since the 1970s, finance has become the decisive economic power compared to the producing economy. Increasing amounts of money circulate worldwide in search of lucrative investment opportunities. Urban spaces prove to be ideal places for a spatial fixation of this financial capital. Invested in urban real estate, capital is not only “parked” safely, but also increased through direct skimming and specific real estate-based financial products. Old-age pensioners or small investors are also induced to participate in the financial market by political decisions and the offers of new financial service providers. Where rental houses become pure forms of investment, conventional notions of land and property ownership and the responsibility associated with them no longer apply. This trend, which has already taken hold in many places worldwide, arrived in Germany with a delay: trading in real estate securities and their derivatives, the so-called financialisation of the real estate market.

The structural violence that arises from the conversion of rental flats into condominiums and the multiplication of rents for small businesses, living, working and leisure spaces ultimately leads to the socio-economically marked segregation and displacement of many people. Financialisation appears here as an inscrutable outside: as something that seems systemically conditioned and thus inevitable. The feeling of being exposed to an intangible development and not being able to shape it makes self-determined ways of dealing with it and counter-designs more difficult.

The structural violence resulting from the conversion of rented flats into owner-occupied flats and the multiplication of rents for tenants is a problem that has not yet been solved. Many tenants’ initiatives start with the question of the identity and responsibility of the new owners. The investors behind the real estate funds – those who cause and benefit from excessive rents, lack of maintenance, forced move-outs and speculative vacancies – are difficult to identify because of the lack of transparency laws. And thus there is also a lack of strategies on how to interrupt such one-sided value creation, organise campaigns and develop a liveable city for all.small businesses, living, working and leisure spaces arise, ultimately leading to socio-economically marked segregation and displacement of many people. Financialisation appears here as an inscrutable outside: as something that seems systemically conditioned and thus inevitable. The feeling of being exposed to an intangible development and not being able to shape it makes self-determined ways of dealing with it and counter-designs more difficult.

Edited by four members of the nGbk project group X Properties, this issue of the Berlin booklets on the history and present of the city brings together global perspectives on urban transformations in Brazil and the UK as well as case studies on financialisation from different Berlin contexts.

The programme of events includes artistic-performative works in urban space: knowbotiq reflects the infrastructural accesses to the extended corporealities in a financialised urban environment, into which Pablo Torres intervenes with sound traces. coop disco outlines urban planning visions for a diverse common good on a five-part banner. Ines Schaber and Kathrin Wildner explore an area in Wedding where five apartment buildings belong to Albert Immo Properties. This is associated with Victoria Immo Properties V, which owns Oranienstraße 25. Schaber and Wildner observe, collect narratives and discuss in two city walks the question of whether financialisation is visible and what other signs of history, change and resistance we can sense. A workshop with activist Lorena Jonas takes up the topics of land value and owner research, deepened by a lecture by geographer Susanne Heeg. In a radio feature, activists and communicators Wouter Bernhardt, Jenny Goldberg and Sandy Kaltenborn discuss language(s), images and utopias in the rent movement and urban design. Louis Moreno, Alexis Hyman Wolff, Achim Lengerer and Yves Mettler present different perspectives on urban and social geographies of financialised urban development using the examples of London and Berlin’s Europacity.

WHEN?

Exhibition dates:

Sunday, 11 September 2022 – Thursday, 15 December 2022

COSTS?

Entrance free

WHERE?

nGbK, Oranienstraße 25, 10999 Berlin-Kreuzberg – after announcement!